With the rise of financial crimes in today’s economy, you may find yourself facing serious allegations that could impact your future. Denver white collar attorneys employ a variety of strategies to navigate these complex legal waters, including meticulous investigation, expert testimony, and robust defense tactics tailored to your specific situation. They work diligently to dismantle evidence against you while ensuring that your rights are protected throughout the legal process. Understanding how these legal professionals operate can significantly influence the outcome of your case, allowing you to make informed decisions moving forward.

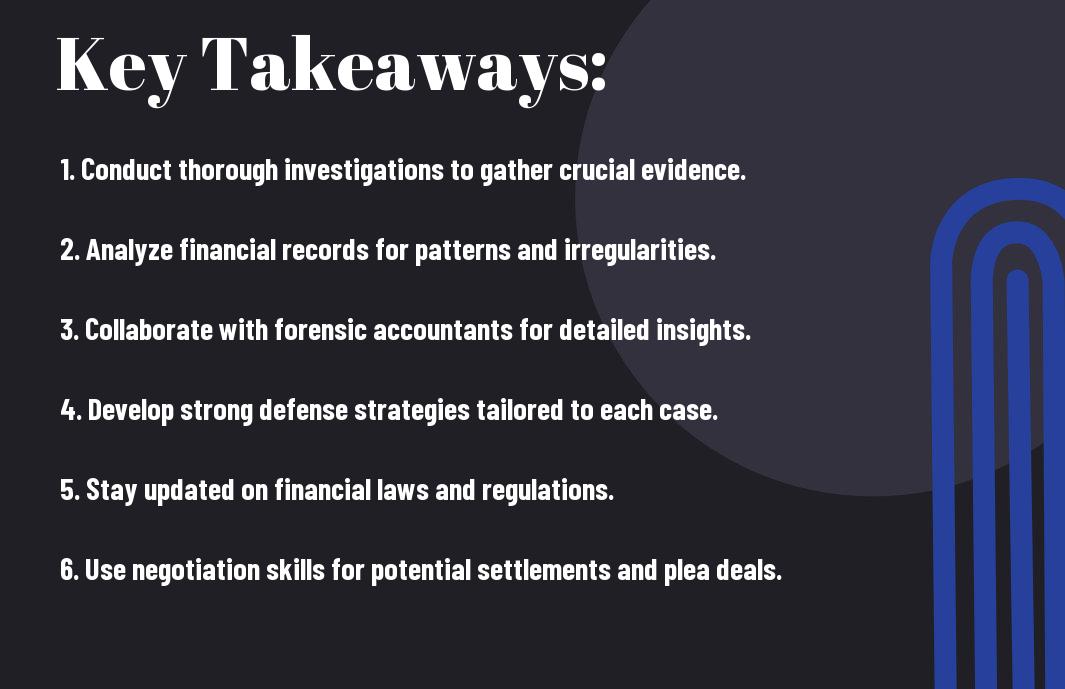

Key Takeaways:

- Denver white collar attorneys employ extensive financial forensic analysis to uncover evidence and dissect complex financial activities in criminal cases.

- They leverage their knowledge of both state and federal regulations to navigate the legal landscape and build robust defenses against charges.

- Attorneys often collaborate with financial experts to provide insights and clarifications that bolster their clients’ positions during legal proceedings.

- Litigation strategies include negotiation of plea deals, engaging in settlement discussions, and, when necessary, preparing for trial to ensure the best outcomes for clients.

- Continuous education and training in evolving financial fraud schemes and technologies allow attorneys to stay ahead in addressing new challenges in financial crime cases.

Understanding Financial Crimes

Before venturing into the intricacies, it’s crucial to grasp the essence of financial crimes. These offenses typically involve deceit for financial gain, affecting individuals, businesses, and the economy as a whole. Understanding the various aspects of financial crimes will empower you to navigate potential legal issues or recognize unlawful activities.

Definition and Types

For an effective grasp of financial crimes, it’s crucial to understand their definition and types. Financial crimes encompass various unlawful acts, including:

| Fraud | Deceptive schemes for financial gain. |

| Embezzlement | Misappropriation of funds entrusted to one’s care. |

| Money Laundering | Concealing origins of illegally obtained money. |

| Tax Evasion | Illegally avoiding tax payment. |

| Securities Fraud | Deceptive practices in trading financial securities. |

Recognizing the various types of financial crimes is the first step toward understanding the legal implications involved.

Common Indicators of Financial Crimes

Above all, various indicators can signify potential financial crimes occurring. Patterns such as unusual financial transactions, discrepancies in financial statements, and sudden lifestyle changes can be red flags for illegal activities.

Due to the complexity of financial crimes, you should be aware of certain red flags that can indicate illicit activities. These include frequent large cash transactions, lack of transparency in financial dealings, and sudden financial gains without clear sources. If you notice any unusual behavior, especially in financial activities, it’s crucial to investigate further. Identifying these common indicators can help you protect yourself and take appropriate actions if necessary.

Role of Denver White Collar Attorneys

The role of Denver white collar attorneys is pivotal in managing complex financial crimes. These professionals not only defend clients accused of various offenses but also provide comprehensive guidance throughout the legal process. Their expertise protects your rights while ensuring due process is followed, making them indispensable advocates in high-stakes situations.

Legal Expertise

One significant aspect of white collar attorneys’ roles is their profound legal expertise. They possess an in-depth understanding of laws related to fraud, embezzlement, and insider trading, which enables them to devise effective defense strategies tailored to your specific case. With their experience, they can navigate the intricate legal landscape to help you achieve the best possible outcome.

Navigating Regulatory Frameworks

Between local and federal regulations, navigating regulatory frameworks can be daunting. Denver white collar attorneys assist you in understanding the relevant compliance issues and legal implications surrounding your situation.

Collar crimes often entail a web of complex regulations that can be challenging for individuals to decipher. Your attorney will help you manage these obstacles by providing insight into relevant laws and guidelines. They will identify potential violations while working to ensure that you comply with necessary regulations, thus protecting you from serious legal penalties. This level of understanding helps you navigate the intricate legal system, allowing you to focus on your defense while they handle the complexities of your case.

Investigative Strategies

After identifying the specifics of a financial crime, Denver white collar attorneys employ various investigative strategies to build a robust defense. They meticulously analyze the circumstances surrounding the allegations and gather pertinent information, ensuring that every angle of the case is explored. By understanding the intricacies involved in financial cases, attorneys effectively position their clients to challenge any unwarranted claims.

Gathering Evidence

On your defense journey, gathering valid evidence is imperative. Attorneys utilize legal tools such as subpoenas and depositions to obtain documents and testimonies that can significantly impact the case. This comprehensive approach ensures that you have a solid foundation to refute allegations or support your narrative.

Collaborating with Financial Experts

Before stepping into complex financial details, your attorney often collaborates with financial experts who specialize in matters pertinent to your case. This partnership is integral in demystifying confusing financial practices or transactions that could otherwise be misinterpreted by legal authorities.

Considering the complexities of financial crimes, working with financial experts allows you to bridge the gap between legal jargon and real-world financial principles. These experts can provide in-depth analyses, enabling you to understand your situation better and present a robust defense. This collaboration not only strengthens your case but also equips you with the knowledge to navigate challenging discussions and makes it more likely to reveal critical details that can positively impact your outcome.

Defense Tactics

Once again, Denver white collar attorneys utilize a variety of defense tactics to counter complex financial crimes. These strategies not only focus on disproving the prosecution’s evidence but also on highlighting any procedural misconduct. Legal professionals assess the intricate details of your case, including potential defenses such as lack of intent or misunderstanding of financial transactions, ensuring your rights are vigorously protected throughout the entire legal process.

Developing a Strong Defense Strategy

One effective approach involves crafting a tailored defense strategy that addresses the specific nuances of your situation. Your attorney will evaluate evidence, witness testimonies, and potential legal loopholes to create a compelling argument. This personalized strategy aims to position you favorably in negotiations or court proceedings, helping to reduce the chances of severe penalties.

Mitigating Consequences

For many facing financial crimes, mitigating the consequences of a conviction is paramount. Effective legal counsel will work with you to explore options such as plea bargaining, restitution, or rehabilitation programs. By demonstrating a willingness to make amends and take responsibility, you can potentially lessen your sentence or avoid incarceration altogether.

Understanding the legal landscape around financial crimes is important. By actively participating in mitigation efforts, such as engaging in restorative justice programs or demonstrating your commitment to compliance, you can potentially reshape the court’s perception of your case. Through these measures, you can emphasize your dedication to rectifying past mistakes, which may lead to more favorable outcomes in sentencing or even a dismissal of charges, ultimately providing you with a brighter path forward.

Case Studies

For a deeper understanding of how Denver white collar attorneys address complex financial crimes, consider the following case studies:

- Case 1: A local business executive accused of embezzling over $1.5 million, resulting in a multi-year investigation that ended with a plea deal.

- Case 2: In a significant identity theft operation, an attorney helped acquit a client wrongly implicated in a scheme involving over 300 victims and $2.3 million in fraud.

- Case 3: Defense of a prominent financial advisor charged with securities fraud, alleging losses exceeding $4 million, leading to an eventual dismissal of charges.

Notable Cases in Denver

Denver has witnessed several significant financial crime cases, impacting both the judicial landscape and the local community. High-profile instances include intricate embezzlement schemes involving corporate executives and financial advisors who manipulated client funds. Each case not only highlights the potential for significant financial loss but also underlines the importance of expert legal representation in overcoming false allegations and securing just outcomes.

Outcomes and Legal Precedents

For those navigating the complexities of financial crimes, understanding past outcomes can be incredibly enlightening. The resolutions of these cases often lead to new legal precedents that shape future prosecutions and defenses.

Plus, victories in high-stakes cases not only demonstrate the efficacy of robust legal strategies but also can lead to more lenient sentencing in subsequent cases. Furthermore, acquittals set significant precedents that empower individuals facing allegations, indicating that competent defense can make a substantial difference in the legal process. Your awareness of these outcomes can inform your expectations and strategies should you find yourself enmeshed in similar legal challenges.

Ethical Considerations

Despite the complexities involved in financial crimes, Denver white collar attorneys must adhere to strict ethical guidelines. These standards not only ensure justice but also uphold the integrity of the legal system. Attorneys are called to navigate the intricate balance between zealous representation of their clients and the ethical obligations to the court and society. Maintaining this balance can be particularly challenging in cases involving complex financial transactions where the stakes are high.

Responsibilities of Attorneys

Along with providing robust defense strategies, attorneys have the duty to ensure that the legal process is respected. This includes honest communication with the court, avoiding conflicts of interest, and fully informing their clients of the potential consequences of their actions. Your attorney’s responsibility extends to ensuring that your rights are protected, even while navigating intricate legal frameworks.

Client Confidentiality

Client confidentiality is a foundational principle in legal representation. You can expect that all communications with your attorney will remain private, fostering an environment where you can freely disclose all pertinent information without fear of exposure.

Considerations surrounding client confidentiality are vital in white collar crime cases, where the information shared can be particularly sensitive. Your attorney must adhere to strict ethical obligations, ensuring that any details you provide, including financial documents or personal data, are protected from public disclosure. This confidentiality not only builds trust but also empowers you to be open about your circumstances, allowing your attorney to formulate the most effective defense strategy. Breaches of this duty can have severe legal repercussions for attorneys and jeopardize your case.

Final Words

Conclusively, understanding how Denver white-collar attorneys approach complex financial crimes can empower you to navigate legal challenges effectively. They employ thorough investigations, leverage financial expertise, and craft tailored defense strategies to address intricate issues such as fraud, embezzlement, or money laundering. By prioritizing communication and staying updated with evolving laws, these professionals aim to protect your rights and interests. Engaging a skilled attorney can significantly impact the outcomes of your legal matters, ensuring that you are well-equipped to face any legal repercussions that may arise.

FAQ

Q: What types of financial crimes do Denver white collar attorneys handle?

A: Denver white collar attorneys handle a wide array of financial crimes, including but not limited to wire fraud, securities fraud, tax evasion, money laundering, and identity theft. These professionals are skilled in addressing the complexities involved in each case, which often includes navigating federal and state laws, understanding financial regulations, and dealing with extensive documentation and forensic accounting issues.

Q: How do attorneys investigate financial crime cases?

A: Attorneys typically begin investigations by gathering evidence through various means such as reviewing financial documents, bank statements, and transaction records. They collaborate with forensic accountants and other financial experts to analyze data and uncover patterns that could indicate fraudulent activity. Additionally, they may conduct interviews with witnesses and involve law enforcement if necessary to build a comprehensive case.

Q: What defenses do Denver attorneys use for clients accused of financial crimes?

A: Attorneys may employ various defense strategies, including challenging the sufficiency of the evidence presented by the prosecution or demonstrating that their client did not intend to commit a crime. They might argue that the financial activity was legitimate or was conducted under a misunderstanding of the law. Additionally, attorneys can highlight procedural errors in the investigation that may have violated the rights of their clients.

Q: How do white collar attorneys keep up with changing financial regulations?

A: Denver white collar attorneys maintain their knowledge of financial regulations by regularly attending continuing legal education courses, participating in industry conferences, and subscribing to relevant legal journals. They also engage with professional networks and organizations that focus on white collar crime and financial regulations, ensuring they stay informed about the latest changes, trends, and case law.

Q: What role does negotiation play in financial crime cases?

A: Negotiation is often a key component in financial crime cases, as attorneys may seek to reach plea agreements with prosecutors to reduce charges or penalties for their clients. This process involves assessing the strength of the evidence and the potential risks of trial, allowing for strategic discussions that can lead to more favorable outcomes. Attorneys must possess strong negotiation skills to advocate effectively for their clients and to explore alternative resolutions.